State-of-the-Art Manufacturing Business

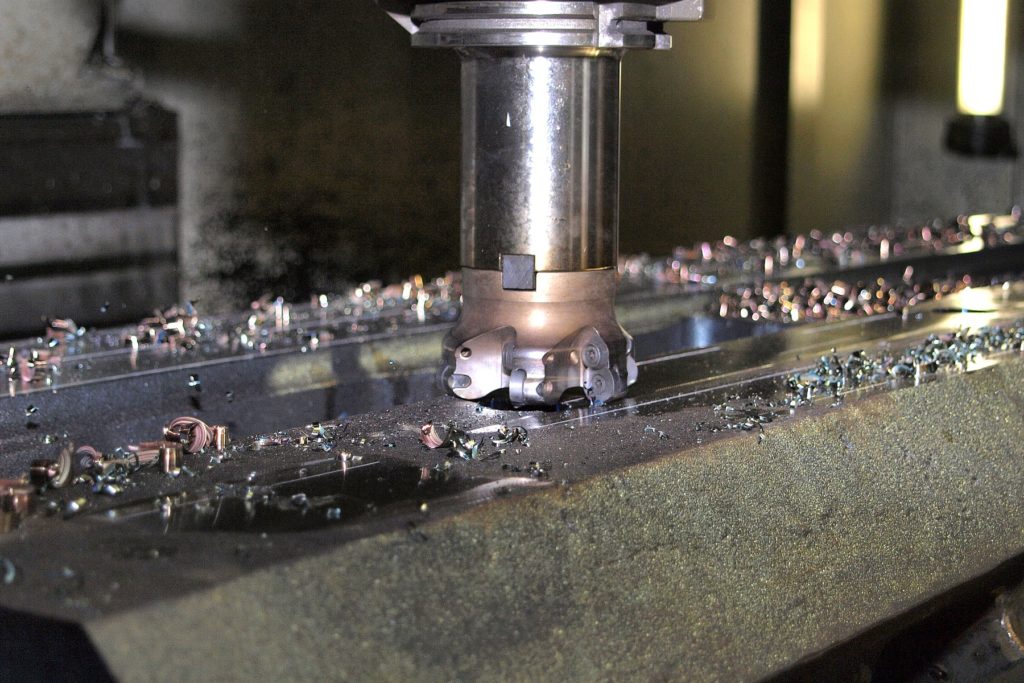

SOLD - NEO Business Advisors represented the seller of a highly profitable manufacturing business in Northeast Ohio with CNC and Manual Machining, Fabrication, Gear Cutting, and Equipment Building capabilities. This rare opportunity had a long and consistent history of generating over 30% EBITDA Margins.

Asking Price: $5,750,000

Gross Revenue: $3,917,492

EBITDA: $1,292,873

SDE: $1,442,873

FF&E: $1,963,570 Included? Yes

Inventory and WIP: $965,207 Included? Yes

Working Capital: $591,352 Included? Yes

Real Estate: $2,200,000 Included? No

Building Size: 40,000 SF

Employees: 13 Employees (including owner)

Location: Ohio

Detailed Information

The company is a one-stop shop for customers in diverse industries that keeps work volume steady and non-seasonal. Equipment is in excellent condition and offers opportunities for growth without additional capital expenses. The business has an excellent reputation for quality, capabilities, and lead time and does not compete based on pricing. The workforce is a good mix of young, eager to learn and experienced, long-tenured employees. The business boasts about 60% repeat work with the remaining work largely variations of past parts and equipment with a 15+ year history of jobs to draw on for quotes, orders, programs, and assembly.

COVID-19 Impact Statement: The business has been operating as an Essential Business throughout COVID-19. Work volume decreased slightly but the business maintained its excellent margins. Inquiry/quote volume has returned to pre-COVID levels.

Financial Overview:

Revenue by Year:

2021 Revenue $ 3,890,639

2020 Revenue $ 3,395,517

2019 Revenue $ 4,048,063

2018 Revenue $ 4,335,747

Adjusted EBITDA by Year:

2021 EBITDA $ 1,225,682 (31.5%)

2020 EBITDA $ 1,161,015 (34.2%)

2019 EBITDA $ 1,390,412 (34.3%)

2018 EBITDA $ 1,394,383 (32.2%)

4 Year Weighted Average EBITDA $ 1,292,873

Furniture, Fixtures, and Equipment (FF&E): FF&E of $1,963,570 is included in the asking price and includes CNC lathes, CNC mills, lathes, horizontal boring mills, vertical turret lathes, gear machines, welders, grinders, work benches, pallet racks, cabinets, paint booth, paint equipment, tooling, inspection equipment, forklift, multiple overhead cranes, computers, desks, chairs, conference table, file cabinets, CAD software, and copier.

Inventory and WIP: Inventory and WIP of $965,207 is included in the asking price to be adjusted up or down for actual amount at time of closing. Inventory and WIP includes raw material, commercial components work-in-process, and finished goods inventory that is in stock and ready to ship for customers.

Real Estate: Real Estate is owned by the Seller and for sale with the business. Estimated value is $2,200,000 not included in the Asking Price. The building is approximately 40,000 SF with 37,000 SF of manufacturing space and 3,000 SF of renovated office space. True manufacturing space with multiple overhead cranes, multiple overhead/dock doors, a great location for labor, close to customers and vendors, with convenient highway access.

Growth and Expansion: The business is a great strategic acquisition opportunity for someone already in the machining, fabrication, gearing or capital equipment industries. Growth and expansion opportunities include developing a marketing plan (digital advertising, pay-per-click, social media advertising, and hiring a sales/marketing professional) to target production and higher margin work. Add or acquire a product line (proprietary, captive, or production oriented). Equipment utilization is about 50% allowing a buyer to add more employees to increase work volume/utilization without additional CapEx. The business runs one shift (M-F). Additional shifts would increase capacity without the need for CapEx, further increasing the already great margins. A buyer in the OEM equipment manufacturing industry could look at this to gain a captive supplier with a full suite of in-house capabilities while a machining or fabrication buyer would gain employees, equipment, customers, and excellent cash flow! The real estate has room for more capacity before outgrowing the current space and additional land for a future building addition.

Support/Training: The owner is willing to include a reasonable transition period to facilitate a smooth transition.

Reason for Selling: Selling due to changing family needs.

Contact Broker

Do you have a similar business you are considering selling or are you looking to buy a business like this?

At NEO Business Advisors, we look forward to speaking with you about your business needs. For more information on how we can help you, whether you are a business owner or a prospective buyer, please contact us via the contact form below.

NEO Business Advisors, holds all conversations confidentially.