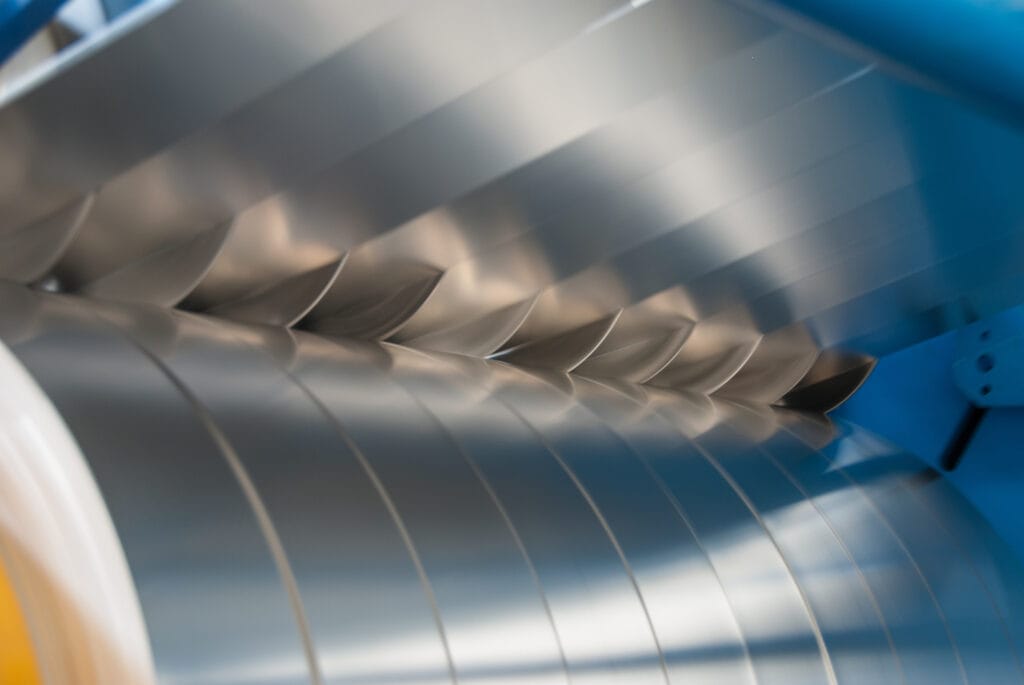

Foil & Sheet Metal Processing and Slitting

UNDER CONTRACT - NEO Business Advisors represents a long-established and profitable sheet metal processing and slitting business specializing in thin gauge materials. The business is a well-established foundation for an industry buyer in the metal distribution space looking to add processing and slitting capabilities or for an existing metal processing and slitting company to acquire additional capabilities, an experienced team of employees, and a well-equipped facility.

Asking Price: $6,100,000

Gross Revenue: $6,819,480

Adj EBITDA: $907,586

FF&E: $333,486 Included? Yes

Inventory: $2,950,000 Included? Yes

Real Estate: Leased for $8,021/month

Building Size: 23,000 SF

Employees: 11 (not including owners)

Established: 2005

Location: Ohio

The business was founded in 2005 by industry veterans with 15+ years in the current facility. The customer base is well diversified serving a wide range of end markets including electrical, stamping, automotive, aerospace, medical, food service and more. The company doesn’t compete on price alone, they win based on quality, quick lead times, and broad capabilities ranging from .0007” foil thicknesses up to .080” sheet gauges with processing widths ranging from .250” up to 64”. The owners are looking for a smooth transition of ownership to a buyer who can continue the legacy of what they have built as they plan for retirement.

Financial Overview:

Revenue by Year:

2023 - $6,819,480

2022 - $7,946,572

2021 - $6,509,277

Adjusted EBITDA by Year:

2023 - $907,586 (13.31%)

2022 - $1,542,982 (19.42%)

2021 - $974,395 (14.97%)

Weighted Average Adjusted EBITDA - $1,130,530

Furniture, Fixtures, and Equipment (FF&E): FF&E of $333,486 is included in the asking price and consists of a variety of slitting, rewinding, sheeting, toll processing, and packaging equipment along with a large tooling inventory of mandrels, blades, and spare parts, multiple tow motors, heavy duty pallet rack storage shelving units, and other support equipment along with all office furniture, computer systems, software, and phone systems.

Inventory: Inventory of approximately $2,950,000 is included in the asking price along with $650,000 in Accounts Receivable and $500,000 in Accounts Payable as part of a normal level of Working Capital of $3,100,000 with the final sale price to be adjusted up or down for actual amount of Working Capital at time of closing. Inventory consists of a wide variety of raw materials including copper, aluminum, nickel silver, brass, stainless steel and more as well as packaging materials.

Real Estate: Real Estate is leased by the Company on a year to year lease for $8,021/month. The building is in excellent condition with approximately 20,000 SF of manufacturing and heated warehouse space with multiple drive-in and dock doors, and approximately 3,500 SF of office space with conference rooms, sales offices, and administrative space.

Growth and Expansion: The business offers an extremely well-established foundation and brand reputation a buyer can build on. The business is well situated for a strategic buyer who has the financial resources and runway to invest in growth. The spike in 2022 revenue and profitability are directly attributed to having more inventory on hand as several large shipments of material arrived in 2022 over a year late from COVID related freight delays. The availability of the inventory on hand directly translated to increased sales without additional fixed overhead resulting in higher profitability. The Company had to leverage financing for this inventory influx, however it showcased the opportunity that exists for a buyer with greater scale and financial resources.

Reason for Selling: The owners are selling to retire.

Support & Training: The owners are willing to stay on for a reasonable time after a sale to ensure a smooth transition of the business operations and relationships with a desire to be fully transitioned out of the business by June 2025 with mutually agreeable terms and compensation during the transition period.

Contact the Seller

We look forward to speaking with you about our business for sale listing details. For more information, please complete the contact form below.

NEO Business Advisors, holds all conversations confidentially.