Profitable Plastic Extrusion Company

SOLD - NEO Business Advisors represented the seller of a plastic extrusion business in Ohio with consistent profitability. This was an excellent opportunity to acquire a successful 2nd generation family run business that was well organized and had an excellent brand reputation with long standing customer relationships. The company maintained higher than industry average EBITDA Margins averaging 13.2% over the past 5 years with SDE of 15.9% over the same period.

Asking Price: $4,250,000

Gross Revenue: $6,173,165

SDE: $840,513

EBITDA: $690,513

FF&E: $925,000 Included? Yes

Inventory: $1,150,000 Included? Yes

Real Estate: $1,000,000 Included: No

Building Size: 50,000 SF (approx.)

Employees: 42 Employees (28 FT / 3 PT / 11 Temp)

Established: 60+ Years

Location: Ohio

Detailed Information

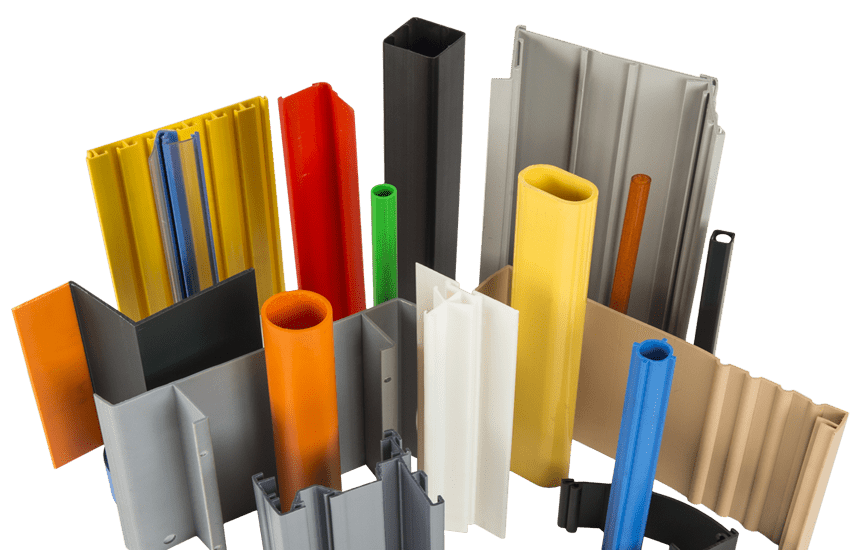

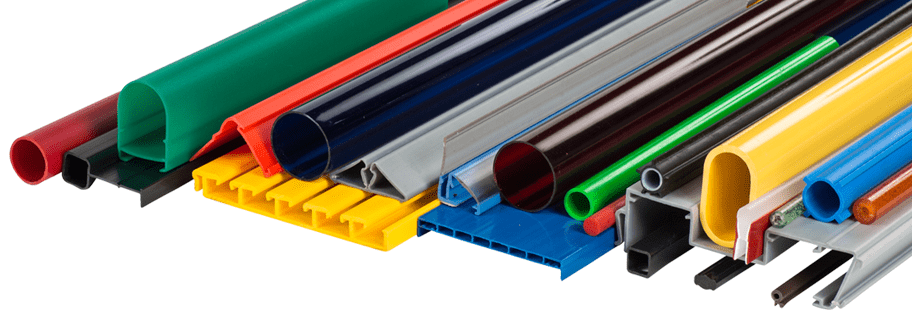

The company worked with a variety of materials for Rigid, Semi-Rigid, and Flexible part specifications to meet the demands of customers in a wide variety of industries including agriculture, building and industrial supply, pet products, lighting, marine, transportation, retail display, and more. The equipment was well maintained including an in-house tool room for die making and repair that offers a buyer opportunity for growth without additional CapEx. The business had a stable and long tenured workforce and customer base key to reducing risk for a buyer.

COVID-19 Impact Statement: The company operated as an Essential Business throughout COVID-19. Work volume decreased in 2020 and rebounded in 2021 with 28% growth over 2020 and 13.7% growth over 2019.

Financial Overview:

Revenue by Year:

FYE 2022 Revenue $ 6,173,165

FYE 2021 Revenue $ 6,066,495

FYE 2020 Revenue $ 4,738,161

FYE 2019 Revenue $ 5,335,915

FYE 2018 Revenue $ 5,269,216

EBITDA by Year:

FYE 2022 EBITDA $ 690,513

FYE 2021 EBITDA $ 875,663

FYE 2020 EBITDA $ 418,963

FYE 2019 EBITDA $ 646,589

FYE 2018 EBITDA $ 995,753

4 Year Average EBITDA: $ 802,130

(25% 2022, 25% 2021, 25% 2019 and 25% 2018 - excluding 2020)

Furniture, Fixtures, and Equipment (FF&E): FF&E of $925,000 was included in the asking price. Manufacturing equipment included twelve plastic extrusion lines, hundreds of dies, various support equipment, in-house tool and die room complete with CNC milling and wire EDM, and a quality control room with inspection equipment. Office equipment included computers, desks, chairs, conference table, file cabinets, records, and CAD/CAM software.

Inventory: Inventory of $1,150,000 was included in the asking price to be adjusted up or down for actual amount at time of closing. Inventory included raw material purchased compounds, regrind, mixed compounds, color concentrates and some packaging which was critical to stock to meet customer lead times. The company also offered some stock profiles for common applications and carries some finished goods inventory included in this number.

Real Estate: Real Estate was owned by the Seller and for sale with the business. Estimated value was $1,000,000 not included in the Asking Price. The building was approximately 50,000 SF of manufacturing and office space. Facility was well suited for the current business and well equipped for manufacturing.

Growth and Expansion: The company was an excellent acquisition opportunity for an entrepreneur looking to buy a profitable manufacturing company in an industry well positioned for growth and longevity. The company would also have been a great strategic acquisition for someone already in the industry looking to add a new location to expand their capacity, capabilities, customer base, and/or acquire skilled employees. The company could be grown organically through the development and implementation of a strategic marketing plan and hiring an additional salesperson to target new customer accounts and end markets. The company had begun doing this and already seen growth in new customer accounts and end markets to help diversify customer and industry concentrations. The current equipment was underutilized and offers significant opportunity for growth through improved scheduling and utilization across shifts without additional CapEx

Support/Training: The owner was willing to include a reasonable transition period to facilitate a smooth transition.

Reason for Selling: Retirement.

Contact Broker

Do you have a similar business you are considering selling or are you looking to buy a business like this?

At NEO Business Advisors, we look forward to speaking with you about your business needs. For more information on how we can help you, whether you are a business owner or a prospective buyer, please contact us via the contact form below.

NEO Business Advisors, holds all conversations confidentially.